Scan the code and contact me

Recently, the International Association for the connection of electronic industries (IPC) surveyed and interviewed hundreds of enterprises in North America, Asia Pacific and Europe. It was found that 88% of the respondents experienced an increase in the delivery time of semiconductors and related components, and 31% of the surveyed companies delayed the delivery of orders by 8 weeks or more.

According to the survey, the rising cost of materials and labor, backlog of orders, inventory reduction and so on are the problems faced by the vast majority of electronic manufacturers. More than 50% of manufacturers believe that the rise in material prices is very significant, and nearly 70% of companies' labor costs have increased.

In addition, the recruitment and retention of technical talents is also a big problem. More than 60% of Companies in North America and Europe are difficult to recruit technical talents. Shawn dubravac, chief economist of IPC and chief researcher of this survey, said: "supply shortages and other disruptions are affecting the global electronic supply chain and every downstream industry served by these manufacturers."

1

90% of respondents said that the price of materials increased

Only 7% of manufacturers said that the problem of core shortage could be solved this year

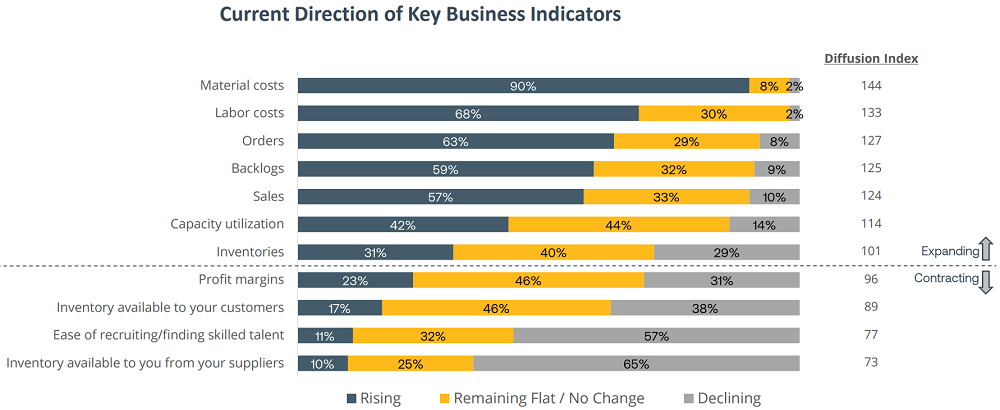

During the epidemic, material costs, labor costs, orders, and overcapacity are recognized as key business indicators that have increased.

In fact, 90% of the respondents found that the price of materials had increased, and only 2% of the manufacturers believed that the price of materials had declined. Correspondingly, more than 65% of the surveyed manufacturers think it is difficult to obtain the required materials from suppliers.

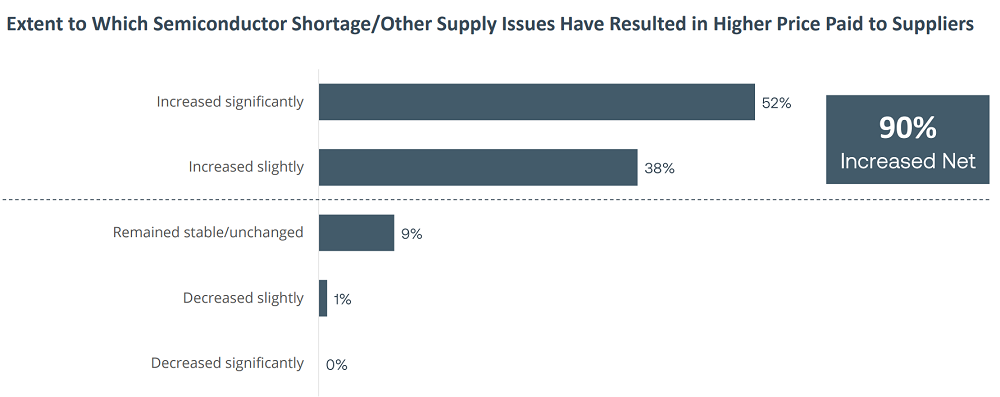

In the survey, more than 52% of the manufacturers chose "the shortage of semiconductors has led to a significant increase in the price they pay to suppliers", and no manufacturer believes that the price of semiconductors and other materials has decreased significantly.

Global electronic supply chain survey: 50% of manufacturers report sharp rise in material prices, and 80% of manufacturers lack qualified workers

▲ 90% of companies believe that the shortage of semiconductors has led to the rise of raw material prices

The report shows that most manufacturers in the three regions have felt the rise in material prices. 90%, 93% and 87% of manufacturers in North America, Europe and Asia Pacific respectively believe that the price of materials has increased.

Under the pressure of material prices and inventory, most manufacturers are not optimistic that the shortage of semiconductors can be solved before the second half of 2022.

Compared with 58% of manufacturers who believe that the semiconductor shortage will be solved after the second half of 2022, only 7% of manufacturers believe that the semiconductor supply shortage can be solved before 2021.

Most manufacturers expect that in the next six months, material prices will continue to rise, and indicators such as orders and sales capacity utilization will be relatively stable.

Global electronic supply chain survey: 50% of manufacturers report sharp rise in material prices, and 80% of manufacturers lack qualified workers

▲ current trends of key business indicators in the supply chain

2

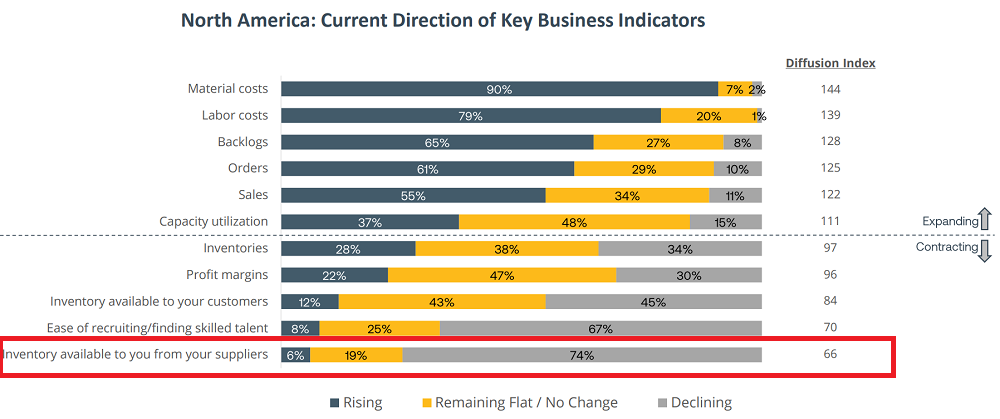

More than 70% of North American companies say supplier inventory is decreasing

Less pressure on enterprises in Asia Pacific Region

Affected by inventory, most manufacturers report that the backlog of orders is increasing. This also increased the concerns of most manufacturers about inventory, and only 10% of companies said that their suppliers' inventory was increasing.

In contrast, Asia Pacific manufacturers have the least inventory pressure, with only 43% of respondents believing that suppliers' inventory is decreasing, while the proportion of manufacturers surveyed in North America and Europe is 74% and 65% respectively.

Global electronic supply chain survey: 50% of manufacturers report sharp rise in material prices, and 80% of manufacturers lack qualified workers

▲ trend of key business indicators of manufacturers in North America

Due to the backlog of orders and the rising cost of materials and labor, the profit margin of supply chain manufacturers has also declined. Although the number of orders generally increased, more than 77% of manufacturers said that their profit margin had not changed or decreased.

In terms of regions, the profit margin of manufacturers in the Asia Pacific region with the lowest inventory pressure is relatively good, with 25% of manufacturers saying that the profit margin has increased, and the proportions in Europe and North America are 17% and 22% respectively.

In the face of such findings, John Mitchell, President of IPC, commented: "although people have paid a lot of attention to the shortage of semiconductors, it should be pointed out that global electronic companies are facing more shortages, order backlogs, inventory reductions and rising material prices."

He also stressed that the current situation cannot continue. If the semiconductor shortage continues beyond 2022, as most companies worry, the above problems will have serious consequences for all industries related to electronic manufacturing.

3

Labor costs rose significantly

40% of the manufacturers choose to increase their salaries and retain employees

For many manufacturers, there is another point that affects their operations in the epidemic, that is, labor costs.

Overall, the rising index of labor costs ranks second among all indicators. 68% of manufacturers believe that labor costs have increased, and only 2% of manufacturers believe that labor costs have decreased.

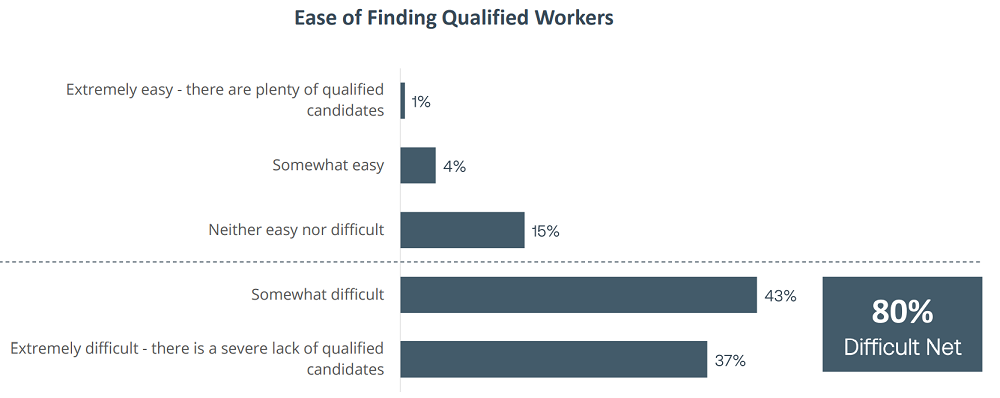

In fact, four fifths of manufacturers said it was difficult to find qualified workers, and 37% of them encountered extreme difficulties. Only 1% thought it was very simple to find qualified workers.

Global electronic supply chain survey: 50% of manufacturers report sharp rise in material prices, and 80% of manufacturers lack qualified workers.

▲ 80% of manufacturers think it is difficult to find qualified workers

In addition to workers, the difficulty of recruiting and retaining technicians has also increased. The survey shows that more than 57% of manufacturers mentioned that it is more difficult to recruit or find technical talents, and only 11% of manufacturers said it is easier to recruit or find technical talents.

Although companies in the three regions are facing recruitment problems, there are certain differences in recruitment in Europe, Asia Pacific and North America. Compared with 79% of North American companies and 63% of Asia Pacific companies that believe that labor costs are rising, the proportion of European companies facing rising labor costs is only 45%.

As for the recruitment of technical personnel, it is easier for companies in the Asia Pacific region to recruit technical personnel. More than 60% of Companies in North America and Europe say that the recruitment difficulty is rising, while the proportion of Companies in the Asia Pacific region is only 33%.

In the next six months, the rise in labor costs is still the highest indicator except for material costs, but many manufacturers believe that the difficulty of recruiting technicians will decrease in the future.

In contrast, manufacturers in North America and Europe are the most pessimistic about this. More than 40% of manufacturers in both regions believe that the difficulty of recruiting technicians will continue to rise in the next six months, while only about 20% of Companies in the Asia Pacific region agree with this view.

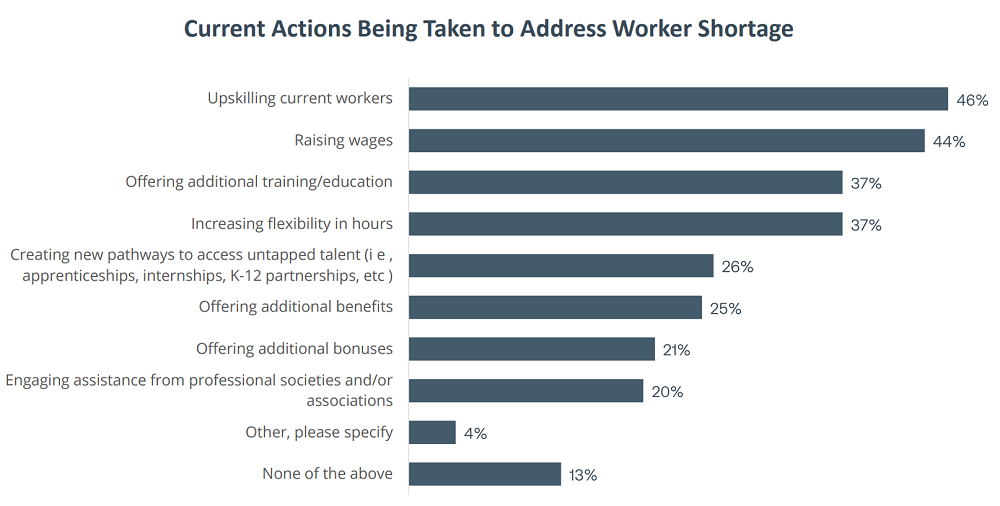

In order to solve the problem of difficult employment, many companies have adopted ways such as improving the skills of existing employees, increasing wages, providing additional training, increasing the flexibility of working hours, developing talents through apprenticeships / internships, providing additional benefits, extra bonuses, seeking professional associations, etc.

Among them, upgrading the skills of existing employees is the way most companies choose, and 46% of companies choose this way. In addition, 44% of companies choose to raise wages, while 37% choose to provide additional training and improve working time flexibility.

Global electronic supply chain survey: 50% of manufacturers report sharp rise in material prices, and 80% of manufacturers lack qualified workers

▲ methods adopted by enterprises to make up for the shortage of workers

4

Conclusion: the lack of core may continue until the second half of 2022

Or affect the development of the global electronic industry

The shortage of semiconductors has become a problem that needs to be solved in many industries, such as electronics and automobile. Although the revenue and net profit of many large chip manufacturers are on the rise, many manufacturers in the supply chain are suffering from difficulties in labor, materials and inventory.

For chip manufacturers such as TSMC and Samsung, although they have announced plans to expand production, it is difficult to improve the current core shortage dilemma in the short term. According to this IPC survey, the industry generally believes that the semiconductor shortage may continue beyond 2022, which will also have a certain impact on the development of semiconductor and even the global electronic industry.

END

Source: eeworld electronic engineering world copyright belongs to the original author. If there is infringement, please contact to delete.